Market Update - November 2025

Seattle Area Eastside Residential Real Estate Market Update

October’s months supply of inventory rose to 2.6, matching the highest October level since 2022. This increase is largely due to a 76% rise in active listings year-over-year — from 675 in October 2024 to 1,191 in 2025. Demand softened slightly, with pending sales down 14% (from 541 to 466), but supply-side growth is the primary driver of the shift. The Eastside’s rapid move from 1.2 to 2.6 months of inventory in just a year reflects a decisive return toward a balanced market, although it feels like a buyer favored market after over five years of a seller favored market. The steep rise from October 2021 (0.3) to October 2022 (2.4) was the result of interest rates increasing from 3.07 (October 2024) to 6.90% (October 2025)

The median sale price held steady year-over-year at $1,550,000, though that’s down 9% ($160,000) from the March 2025 peak of $1.71M. Prices have declined roughly 1% per month for seven consecutive months, giving buyers a sense of reward for waiting. As a result, buyers are hypersensitive about condition, price and location. If anyone of the three are not right for the buyer they simply won’t make an offer. Homes that check all the boxes are receiving multiple offers. 1 in 6 or 17% of October closed sales, sold for over original list price.

Looking ahead, historical patterns suggest lower seasonal demand through the holidays. Based on pending trends and active inventory, January 2026 is expected to begin with elevated inventory. Unless interest rates move materially lower, prices are expected to remain flat or continue to drift down.

If you are interested in the data in Seattle or other cities, or for more in-depth discussions of your buying or selling strategies in this current market condition, feel free to reach out to me at (206) 779-3023 or mei@meiyangrealestate.com.

Market Update - October 2025

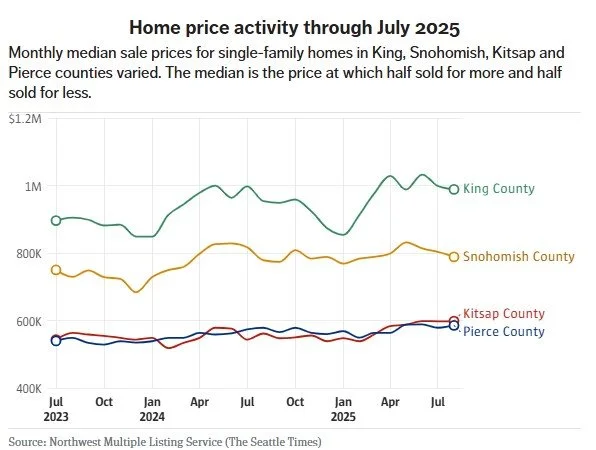

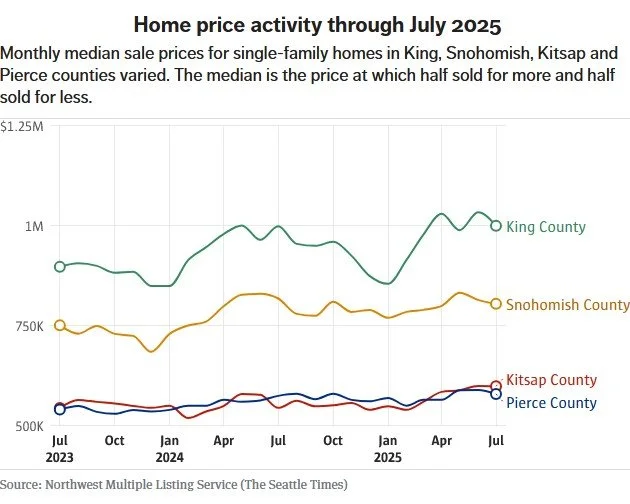

In the waning days of summer, the local real estate market reflected a mix of shifting prices, easing mortgage rates, and continued annual growth in inventory. Some areas still favored sellers benefiting from demand, while others gave buyers increasing leverage. Together, declining interest rates and higher supply could motivate cautious buyers to re-enter the market this fall.

As of the second week of September, mortgage rates reached their lowest point in 10 months, sitting at 6.35% for a 30-year-fixed-rate loan. Whether this is enough to draw more buyers into action remains to be seen, but it is welcome news for sellers contending with significantly higher inventory and tempered demand amid broader economic uncertainty. How this dynamic plays out in the coming months — particularly as the market enters a seasonal slowdown — will be important to watch.

KING COUNTY

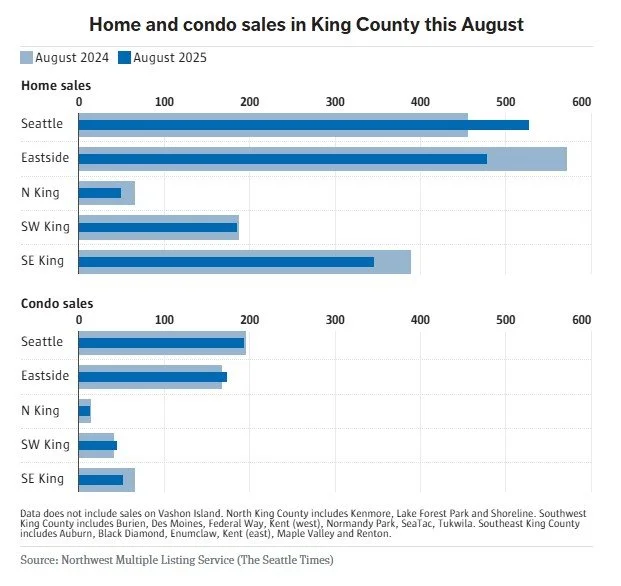

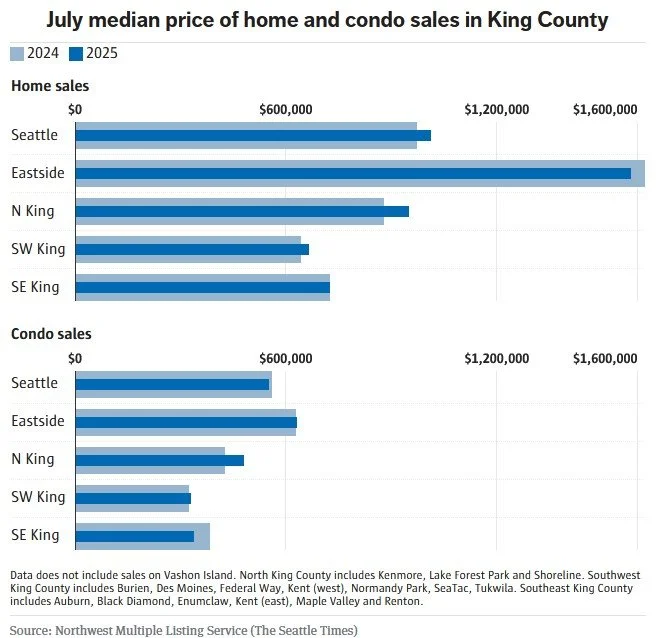

Last month, the median residential sold price in King County rose 4% year over year to $990,000, up from $955,000 in August 2024. The monthly trend was a bit more encouraging for buyers, however, as August’s median sold price dipped 1% from July’s $1,000,000. Active listings were 32% higher than a year ago, expanding options for buyers across the county. In the condo market, prices increased 4% year over year to $549,000, even as supply climbed 29%.

SEATTLE

Seattle’s median single-family home price climbed 8% year over year to $1,000,000, though this marked a 1% dip from July’s $1,010,000. At the same time, inventory rose 17% compared to last August. Condo prices advanced 7% year over year from $555,000 to $595,000, with active listings up 24%. Throughout the summer, Seattle remained one of the more competitive markets in the region, with buyers and sellers adapting to higher prices and rising supply.

EASTSIDE

On the Eastside, the median sold price for a single-family home was $1,537,500 in August, down 1% year over year and 3% from July. Closed sales fell 16% annually, while inventory surged 69%. Motivated sellers had to be flexible to beat out competition last month as nearly 70% of homes sold under list or after a price reduction — a sharp contrast from 2024 when fewer than half did. Meanwhile, the Eastside condo market showed notable strength: median prices jumped 17% year over year to $717,500, with active listings up 48%.

SNOHOMISH COUNTY

Snohomish County saw softer activity in August. Pending sales of single-family homes declined 12% and closed sales dropped 11% compared to last year, while active listings increased 47%. Median sold prices inched up 1% year over year to $790,000 but slipped 2% from July’s $805,000. This month-over-month price dip aligns with the county’s shift toward a balanced market. The median sold price for a Snohomish County condo fell to $500,000, a 15% annual drop and a typical market response to rising inventory — which was 64% higher than a year ago.

As fall begins, our local real estate market is showing signs of equilibrium, with opportunities for both buyers and sellers. Inventory growth and easing rates suggest buyers may gain ground, but how supply responds this season remains an open question. In such a rapidly evolving landscape, expert guidance is essential. Partnering with an experienced Windermere agent can help you build a strategy tailored to today’s conditions and tomorrow’s opportunities.

Market Update - September 2025

Info & Graphs from Seattle Times

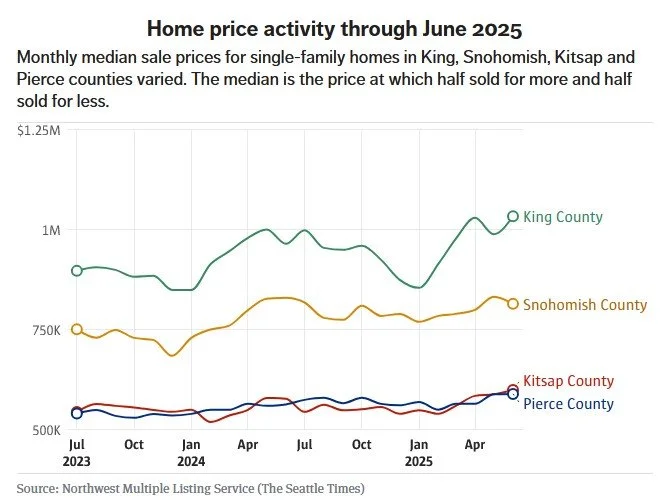

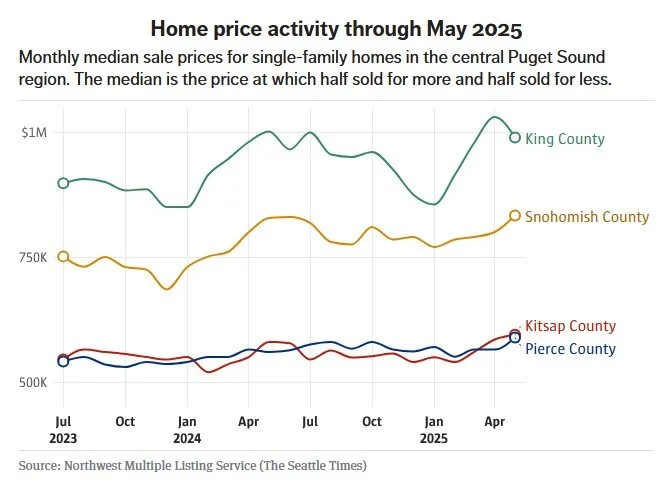

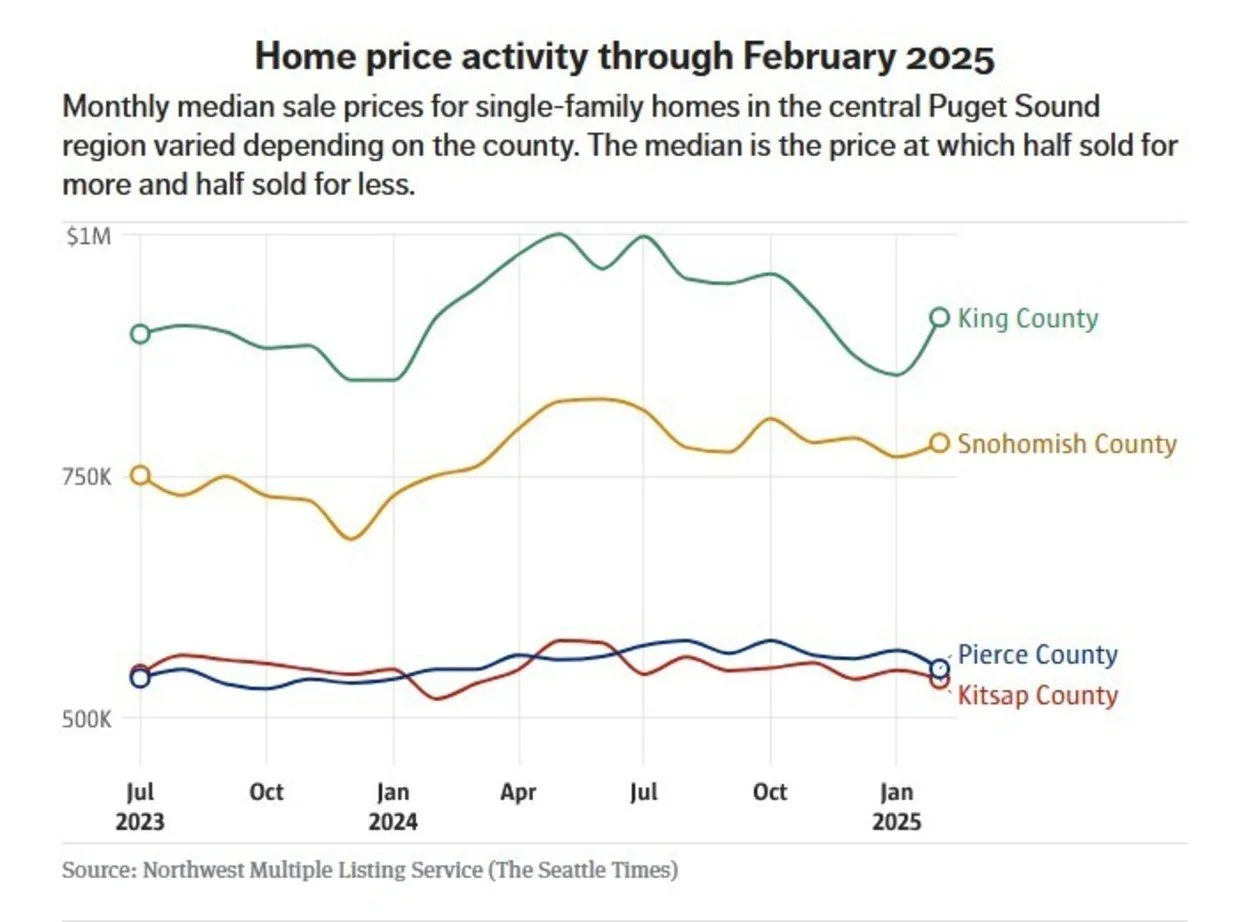

In August, the median sale price of single-family homes in King County was $990,000, up 3.7% from a year ago. The median sale price inched up 1.3% in Snohomish County to $790,000 and 1.2% in Pierce County to $587,000. Prices climbed the most year over year in Kitsap County, with its median sale price up 6.6% to $599,900. In Seattle, the median sale price rose 7.5% from a year ago to $1,000,000.

In King County, August’s active listings for single-family homes and condos were 31% higher, and in Snohomish, the total was 50% higher than the same month a year ago.

Homes that are priced too high will sit on the market longer. On Zillow, the median time from listing to pending is 23 days in Seattle, according to the listing service’s data. But homes that are still active have been up for a median of 48 days.

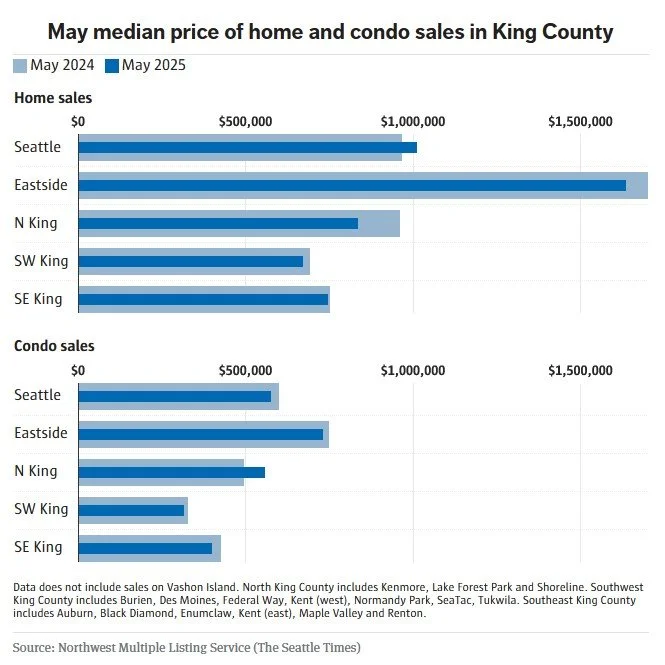

The median sale price of King County condos was up 5% in August from a year ago to $549,000. Seattle condo prices went up more than 7% to $595,000, and Eastside prices leapt up nearly 17% to $717,500.

Mei's Market observation:

Buyers are getting a bit more active now that summer is officially over. It is still a pretty good time for buyers right now. You don't have to rush into making an offer quickly. You can evaluate your options and keep your contigencies and negotiate on price and terms. As for sellers, you really need to make sure that your property is in tip-top condition, priced competitively and promoted extensively. For more in-depth discussions of your buying or selling strategies, feel free to reach out to me at (206) 779-3023 or mei@meiyangrealestate.com.

Market Update - August 2025

Info & Graphs from Seattle Times

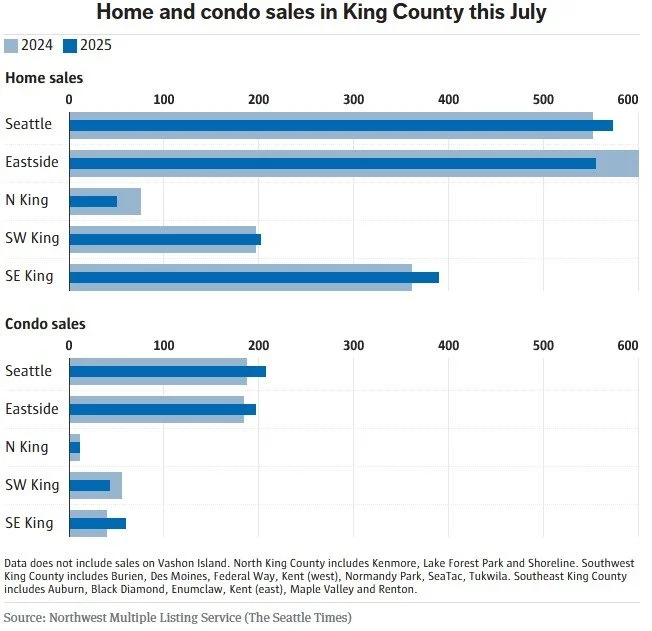

Last month saw notable jumps in newly listed single-family homes and condos across King, Snohomish and Pierce counties compared to a year ago, according to data from Northwest Multiple Listing Service. Seattle area posted one of the biggest year-over-year increases in new listings among major metro areas. In King County, the median sale price for single-family homes was $1,000,000 — virtually unchanged from a year ago. The median home sale price ticked downward 1.6% in Snohomish County to $805,000 but crept up 0.9% in Pierce County to $580,000.

In July, the median home price in Seattle rose by almost 4% to $1.01 million, while falling on the Eastside by about 2.5% to $1.58 million.

Total active listings for condos are way up across King, Snohomish and Pierce counties, while sales have remained either leveled or dipped. Median prices have either stayed the same or fallen. In Seattle, the median condo sale price fell 1.6% to $550,000; on the Eastside, it rose 0.2% to $629,000.

Homes are lingering on the market for a few weeks longer than they were at this time last year.

Mei's Market observation:

It is a good time for buyers right now. You don't have to rush into making an offer quickly. You can evaluate your options and keep your contigencies and negotiate on price and terms. As for sellers, gone are the days that you simply put up a sign, demand a high price and multiple buyers will show up. If you want to sell your house right now, you really need to make sure it is in tip-top condition, priced competitively, promoted extensively and you are open to creative negotiation. For more in-depth discussions of your buying or selling strategies, feel free to reach out to me at (206) 779-3023 or mei@meiyangrealestate.com.

Market Update - July 2025

Info & Graphs from Seattle Times

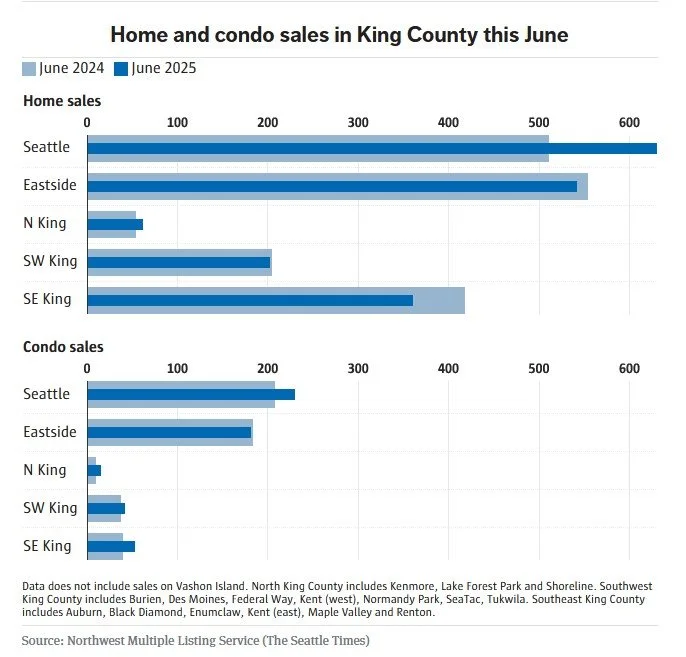

Tech layoffs, economic uncertainty and high mortgage rates continue to keep a lid on the Seattle-area housing market. June marked a continuation of a sluggish year with more homeowners listing their properties for sale than a year ago, but many of those homes are lingering unsold and would-be homebuyers are hanging back, skittish about their budgets and job security.

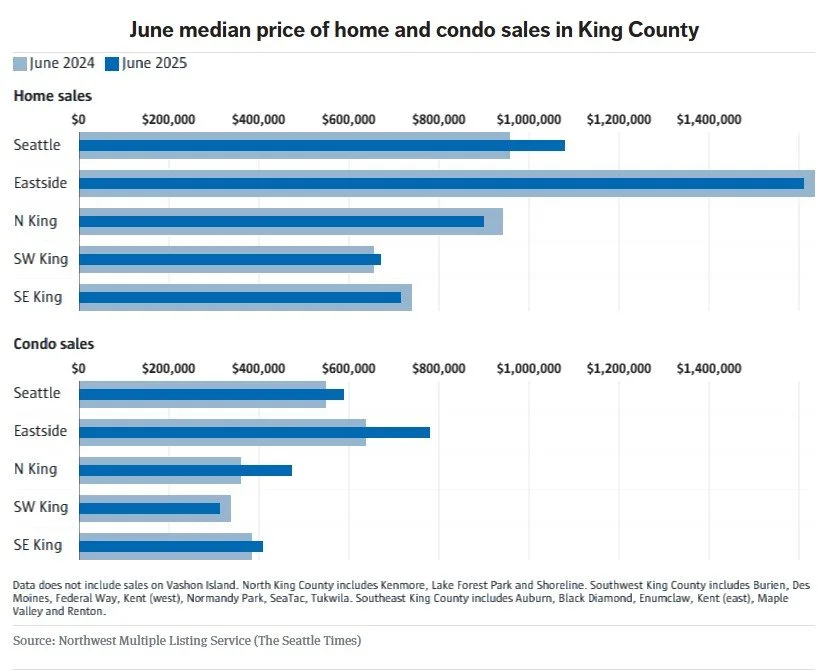

However, prices have not come down much. King County’s median single-family home price actually reached a record high of $1.034 million in June, a tick above the last high of $1.03 million in April and a 7% increase from June of last year. Seattle home prices climbed fastest within King County. The median single-family home sold for nearly $1.1 million, up 13% from a year earlier, even as prices declined in most other areas of the county, including the Eastside.

The number of active single-family home listings in King County last month soared 50% from a year earlier. Inventory also climbed in Snohomish, Pierce and Kitsap counties.

Mei's Market observation:

Summer tends to be seasonally slower than spring. There are many homes on the market. Buyers now have more options to choose from. If you plan to buy, you can negotiate on the price and terms more aggressively. If you plan to sell, summer is a good time to get your property in tip top condition so you can put it on the market in early September. Early fall can bring you more buyers as people return from their summer vacations. For more in-depth discussions of your buying or selling strategies, feel free to reach out to me at (206) 779-3023 or mei@meiyangrealestate.com.

Seattle Area Eastside Market Update - July 2025

Market Update - June 2025

Info & graphs from Seattle Times

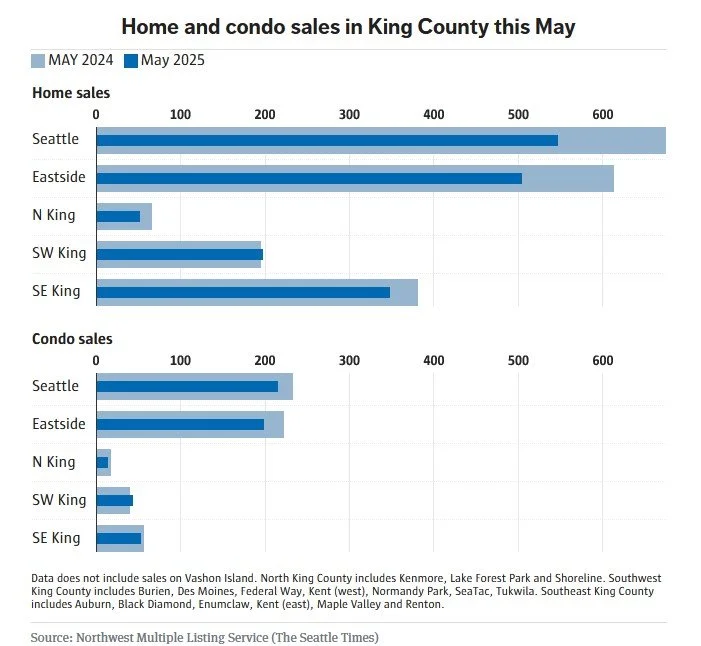

While the early months of this year saw an uptick in Seattle-area home sales,sales dropped as President Trump announced new tariffs, plunging the stock market and discouraging some home shoppers. By the end of May, pending single-family home sales had bounced back a bit, but plenty of buyers continued to play it safe, according to monthly data the Northwest Multiple Listing Service released Wednesday. More sellers put their homes on the market last month, but more of those homes were still waiting for a buyer when the month ended — a sign of cooling buyer interest.

The median single-family home sold for $989,000 in King County in May, down 4% from April and 1% from May of last year. The median single-family home sold for $1 million in Seattle, up 5% from a year earlier, while the Eastside’s $1.6 million median was down 4% from a year ago. Prices also dropped from a year ago in North and South King County. (May prices likely reflect sales that went pending in April and closed last month.) Outside King County, home prices climbed. The median single-family home sold for $833,000 in Snohomish County, up nearly 1% from a year earlier; $589,000 in Pierce County, up 5%; and $594,500 in Kitsap County, up 2.5%.

Mortgage rates averaged just below 7% last week, about where they’ve hovered all year.

Mei's Market observation:

I wish I had a crystal ball so I can tell you where the market is going, but I don't. Right now, it is a Buyer's market. If you plan to buy this Spring or Summer, you have plenty of choices and negotiation power. Therefore, you can aim higher, and you may very likely get a house that you thought out of your price range. If you plan to sell this Spring or Summer, you need to make sure your house is in the best condition possible and you need to price your house competitively and do a lot of targeted marketing. For more in-depth discussions of your buying or selling strategies, feel free to reach out to me at (206) 779-3023 or mei@meiyangrealestate.com.

Market Update - May 2025

Inventory growth Is shaping the market.

On the Eastside,

Active listings have surged, more than doubling from April 30, 2024 to April 30, 2025.

From March 2025 to April 2025 alone, active listings rose 45%. A portion of the increase is seasonal. In 2024 the increase from March to April was 20%.

The months supply of inventory has also more than doubled over the past year, increasing from 0.7 in April 2024 to 1.9 in April 2025. Just from March 2025 to April 2025 the months supply of inventory rose 73%, from 1.1 to 1.9.

Median closed sales price for April was $1,697,500 up slightly, 1%, from a year ago (April 2024 $1,677,500), and is down 1% from March 2025 ($1,710,000).

Pendings sales are down 15% year over year. Closed sales are down 3% year over year.

Multiple offers were 57% of the closed April sales. Up from 54% in March and down from 59% a year ago (April 2024).

In Seattle,

Active listings have increased 47% year-over-year.

Month over Month (March to April 2025), active listings rose 7.7%

The months supply of inventory has gone up 58% over the past year, increasing from 0.9 in April 2024 to 1.4 in April 2025.

Median closed sales price increased 3% year over year (April 2024 $997,900 → April 2025 $1,025,000)

2.5% month over month (March 2025 $1,000,000 → April 2025 $1,025,000).

The median closed sales price came close to reaching the previous peak price of $1,025,500 from May 2022.46% of the homes sold above list price, at a median of 7% above.

It is important to note, the activity creating April sales occurred in March before new tariffs created stock market volatility. Expect the percentage of multiple offers on sales closed in May to decrease more than in 2024 due to the stock market volatility and increase in inventory.

In the near term, sellers will face greater challenges in getting properties sold due to rising competition. Buyers may become less urgent as more options emerge that meet their needs.

Mei's Market observation:

Right now, market is more in buyer's favor becuase of the significant increase in inventory. If you plan to buy this Spring, you can aim at a home that may be a bit over your budget and still get it at a price within your budget, especially if the home has been on the market for more than 10 days. If you plan to sell this Spring, you need to make sure your house is in tip-top showing condition and you need to price your house competitively. For more in-depth discussions of your buying or selling strategies, feel free to reach out to me at (206) 779-3023 or mei@meiyangrealestate.com.

Market Update - April 2025

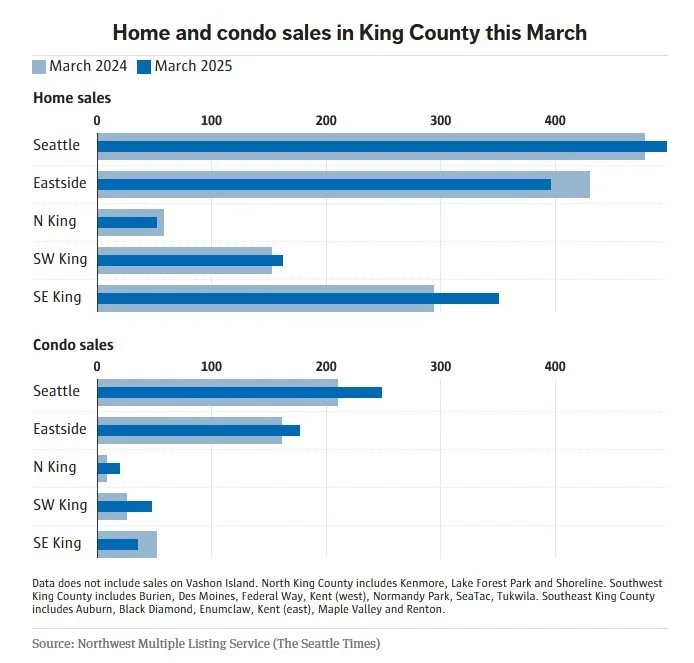

March’s new listings were up 15% in King County, nearly 10% in Pierce and 11% in Snohomish compared with the same month last year. The median home price rose 3.3% in King to $977,500, 3.9% in Snohomish to $790,000 and 2.7% in Pierce to $565,000. The median price for a single-family home sold in Seattle hit $1 million in March, rising 8% from a year ago. On the Eastside, the price rose 1.6% to top $1.7 million.

Across the region, condo prices also climbed. In King County, the median condo price in March was $590,000, up 9% from last year. In Snohomish, the median condo price increased 2.9% to $529,994 and in Pierce it was up 6.7% to $415,000. The condo data includes units in condo buildings and some accessory dwelling units that resemble small single-family homes. In Seattle, the median condo price was $627,650, up 6.8% from last March.

The national economy remains a wild card for the housing market this spring. Consumer confidence has plummeted on the news of a potential global trade war over tariffs. Some national economists have raised the odds of a recession. a recession and job declines could set the Seattle-area market back for a repeat of a weak 2023 market. But mortgage rates tend to drop during economic downturns, and that could also spur demand for homes among those who retain their jobs.

Mei's Market observation:

Because of the volatile stock market and uncertain economic outlook, some buyers are pausing their home purchase plans. The open house traffic slowed down in the past week / weekend.

If you plan to buy this Spring, there might be opportunities for you to secure a perfect home without bidding or even getting a price reduction. If you plan to sell this Spring, you need to make sure your house is in tip-top showing condition and your pricing strategy aligns with the ever-changing market conditions. For more in-depth discussions of your buying or selling strategies, feel free to reach out to me at (206) 779-3023 or mei@meiyangrealestate.com.

Market Update - March 2025

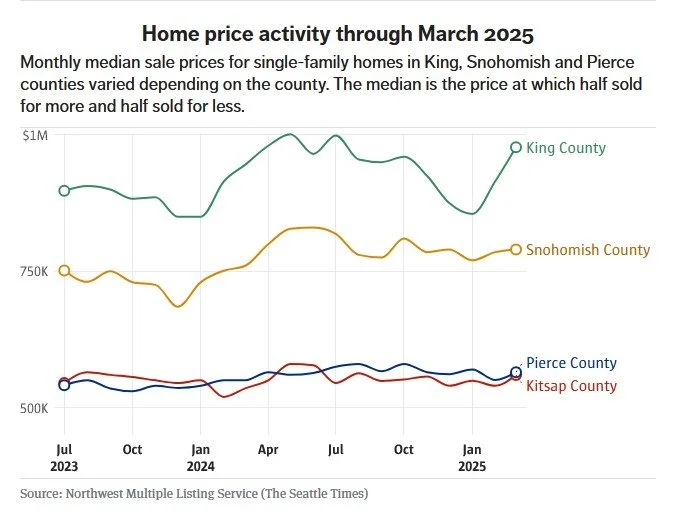

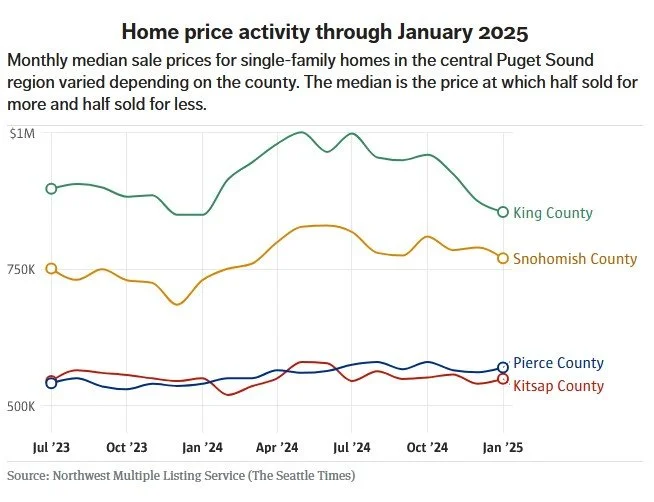

The median price of a single-family home in King County was $915,000, essentially unchanged from a year earlier, according to data released by the Northwest Multiple Listing Service. Single-family home sales volume was flat in King County and declined more than 7% in Seattle. The median sold price of single-family homes was $785,000 in Snohomish County, up 4.5% from a year ago; $550,497 in Pierce County, up 0.09%; and $540,000 in Kitsap County, up 4%.

In Seattle, the median home price was $965,000, up 4%. The Eastside was an exception in price growth, with a whopping 14.6% year-over-year increase, bringing the median home price to $1.68 million.

Condos continued to increase in price after a surge in January. The median Seattle condo price was $625,000, up 12% from a year earlier. The median Eastside condo price was $787,475, up 18%.

Mei's Market observation:

With the recent week's stock market decline, some buyers are hesitating about making an offer. This may present a good buying opportunity for those who are committed to buying a home and holding on to it for a number of years.

If you plan to buy this Spring, I suggest that you visit as many open houses as you can and observe the traffic. Be sure to engage an experienced broker who can be readily available to provide you with market data and formulate a winning strategy to get you the home of your dreams without you overpaying for it. If you plan to sell this Spring, you need to make sure your house is in tip-top showing condition and you price it strategically to maximize the final sold price with the cleanest terms. For more in-depth discussions of your buying or selling strategies, feel free to reach out to me at (206) 779-3023 or mei@meiyangrealestate.com.

Market Update - February 2025

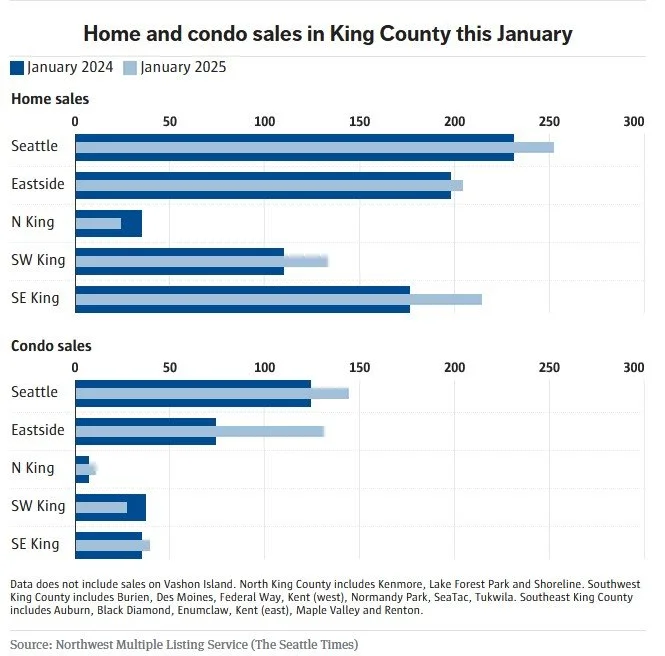

In January, the median home price in King County was $855,000, a mere 0.6% increase from a year earlier. In Seattle, the price of single-family homes declined 1.3% over the year to $857,500.

Elsewhere in the region, the median single-family home sold for about $770,000 in Snohomish County, up 5.5% from a year ago; $569,950 in Pierce County, up 5.5%; and $549,257 in Kitsap County, down 0.13%.

King County condo prices have surged. The median Seattle condo sold for $689,975, up 28% from a year earlier. The median Eastside condo sold for $734,900, up 29% annually. Seattle condos include apartmentlike homes in multifamily buildings and detached accessory dwelling units that resemble small single-family homes and are typically more expensive than other condos.

Sales volumes increased 10.8% year over year across the region. Pending single-family sales climbed nearly 3% year over year in King County and 2% in Snohomish County. Listings in King County also increased from last year’s near-historic lows.

The Eastside is taking the lead again in both sale price and volume increases.

Mei's Market observation:

Market is getting a lot more active compared to November and December of last year. Homes that are in good condition and priced well sell fast with multiple offers, especially homes at $1 million to $2 million price range.

If you plan to buy this year, you need to start actively looking right away and get your finances in order. As soon as you find the right home, you should make an offer. As we head into the spring, you will face more heated competition from other buyers. If you plan to sell this year, you should try to put your house on the market as soon as possible so you can take advantage of the upward price trajectory earlier in the spring selling season. For more in-depth discussions of your buying or selling needs, feel free to reach out to me at (206) 779-3023 or mei@meiyangrealestate.com.

How to price your home for sale?

When you sell your home, how to price it strategically is a crucial step towards a successful sale. When a house first goes on the market, it will receive the most attention from buyers in the first 2 to 3 weeks. Therefore, your goal should be to attract as many buyers as possible during this “golden window” of sales opportunities. This will give you the best chance of receiving an offer (or offers) with the highest price and best terms. What is a common misconception in pricing? Please watch this short video.

Townhomes with NO HOA

Most townhomes have a HOA and therefore HOA dues. In Seattle, sometimes you can find townhomes with no HOA or HOA dues. What are the advantages and disadvantages of such townhomes?

Market Update - January 2025

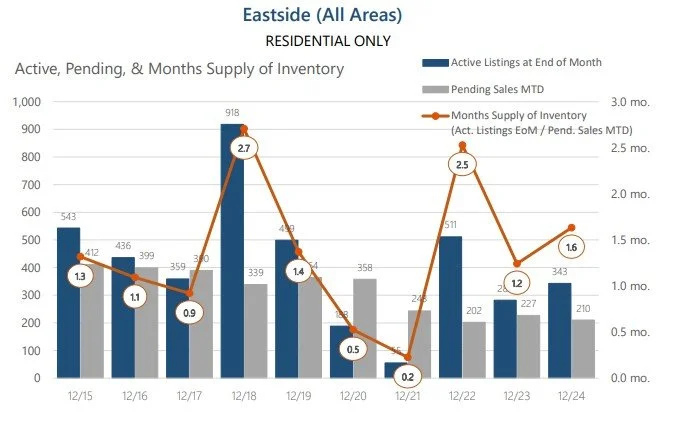

Based on the December data released by NWMLS, the Eastside had 1.6 months supply of inventory, which was the third-highest in the past decade, signaling a seasonal slow down during the holidays and perhaps a market shift. However, 29% of December closings sold at above their original listing prices. The median home price of $1,545,000 was 7% higher than the same period of 2023. In Seattle, December had 1.8 months of inventory. The median home price was $898,900 which was 6% higher than the previous year. At the end of this paragrph, you will see the 10-year trends of inventory levels and median prices of the Eastside and Seattle. If you are interested in the same data of King and Snohomish counties, please let me know.

Mei's Market observation:

Seasonal Trends: Early in the year, demand often outpaces supply, driving prices upward. However, as more sellers list their properties, supply increases, and prices stabilize.

March: Historically, the lowest months' supply of inventory.

May: New listings hit their annual peak.

July: Active inventory levels are at their highest.

Prices: From January to April, prices generally experience notable growth.

If you plan to buy this year, you need to start actively looking right away and get your finances in order. As soon as you find the right home, you should make an offer. As we head into the spring and especially if the mortgage rates come down a bit, you will face more heated competition from other buyers. If you plan to sell this year, you should try to put your house on the market as soon as possible so you can take advantage of the upward price trajectory earlier in the spring selling season. For more in-depth discussions of your buying or selling needs, feel free to reach out to me at (206) 779-3023 or mei@meiyangrealestate.com.

2024 Year in Review

2024 has been a busy and fulfilling year for me in real estate. I helped many clients reach their real estate goals. Throughout each transaction, I formed new friendships or reconnected with previous clients. The "People" factor in real estate gives me the biggest joy. Thank you for your business and referrals! 2025 is around the corner, if buying or selling real estate is on your horizon, let's chat!

Mei’s Tip of the Day

When you remodel your house, whether for selling or your own enjoyment, don't forget to update your ceiling lights. The new flash mount ceiling lights not only look more stylish, they also make your rooms a lot brighter. This is especially important when you sell your house. With the gloomy weather in the Seattle area, interior lighting is very important to make a house feel more cheerful. Buyers tend to be more drawn to houses that are well lit with stylish fixtures. The light fixture below on the right was from Costco, and it only cost $20 (on sale): a small investment yielding big returns!

Homes Sold by Mei in 2023

What is Cap Rate?

Cap rate is the first important concept to understand when you plan to buy an investment property. It is calculated by using the net income that the property generates annually divided by its purchase price. How do you evaluate an investment property’s cap rate?

What kind of broker should you hire?

Selling your home is one of the biggest moves in your life. Choosing the right broker is the key to the successful sale of your home.

Four Tips on Getting Your House Ready for Winter

Winter is around the corner. Mei recommends that you do these four things to prepare your house for the cold and wet season.

Tenant can’t pay. What can Landlords do?

With the increasing unemployment due to the Pandemic, some tenants may have trouble paying rent. If this happens, what should Landlords do? Mei has a few ideas to share with you.